3 Min Read • February 9, 2024

What’s the Key To Win the Automotive Service Wars?

Although 2024 is shaping up to be a buyer’s market, new and used vehicles continue to be painfully expensive for many. That’s why the trend of Americans keeping their cars longer than ever seems poised to continue. It’s typically more cost-effective to fix an older vehicle than spring for a purchase, which should be a driver to service providers. So, where and why are these drivers turning for service and maintenance?

Where Are Car Shoppers Going Most Often for Service?

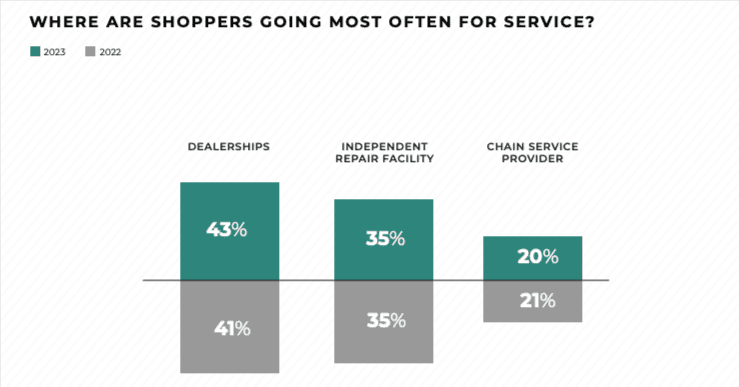

In a recent survey, CDK asked over 2,000 service shoppers where they go most often and why. Slightly more than two out of five, 43%, chose a franchise dealership as their first choice over independents and chains — a positive result compared to last year’s survey but one with plenty of room for improvement.

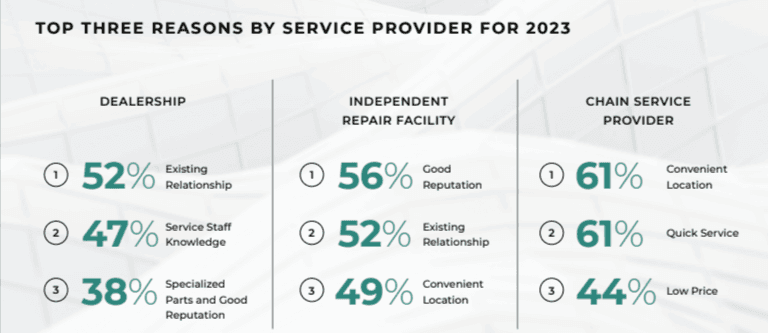

Digging further into why shoppers made the choices they did reveals areas of opportunity that might surprise you. This year, the independent store’s positive reputation was the top reason shoppers selected them. This contradicts the often-held assumption that price is the top factor for selecting the local shop over the franchised dealer. In fact, low price fell to 42% from 50% last year.

Chains, of course, stand out for their convenient location and speed. This is a strength that dealerships simply can’t compete against. Logistically, how can you battle a convenient location?

Reputation Is an Area of Opportunity for Dealers

However, where dealers can battle it out is in the reputation ring. With more than half, 56%, of service shoppers prioritizing reputation, any efforts dealers take to build a positive reputation will likely pay off in more service business.

Most dealerships already use Google surveys to collect customer feedback and opinions to improve operations and services. Any additional social media activities can help, especially among younger generations. It’s estimated that seven in 10 Americans use social media to connect with one another and share information. Social media channels are great for highlighting customer reviews, testimonials, service explainer videos, service promotions, discounts and more.

Franchise dealerships would also do well to connect with loyal service customers online. Slightly more than half, 52%, of service shoppers cite an existing relationship as what draws them to a dealership. You can use social media to connect with loyal customers and give them access to specials, discounts and news. These connections can extend to friend and family networks that can turn into additional service relationships.

Evidence points to family and friends as a powerful factor in where people shop and buy. Among Generation Z, for example, one International Council of Shopping Centers (ICSC) report found that 56% cite family and friends as the most significant influence over their buying decisions.

If you add touch points to a single service visit, it can also help build a strong reputation. Keep the customer informed via text or email on service status, follow up a major service with a call or email, walk the customer to the waiting room or cashier — all small efforts that show genuine concern for a customers’ experience.

While dealership service centers may not be able to compete on location or convenience, they can win the service wars by building a strong reputation. It’s a long game for sure but one worth playing as drivers hold onto older vehicles that require regular maintenance and repairs.

Share This

David Thomas is director of content marketing and automotive industry analyst at CDK Global. He champions thought leadership across all platforms, connecting CDK’s vast expertise to the broader market and trends driving our industry forward. David has spent nearly 20 years in the automotive world as a product evaluator, journalist and marketer for brands like Autoblog, Cars.com, Nissan and Harley-Davidson.