4 Min Read • January 15, 2026

CDK Affordability Tracker Puts Spotlight on Bestsellers

Affordability.

It’s not just a buzzword. It’s not just a media talking point. Higher prices across the board are impacting consumer sentiment and, unfortunately, costs aren’t likely to reverse significantly in the coming months.

In the automotive industry, affordability is often tied to the average transaction price (ATP). However, the ATP is, simply put, an average. An average of every economy car sold and every exotic sports car. Every compact sedan and every full-size SUV. By using this metric and shouting it loudly across media, it’d be easy for people to say the “average car” has gotten too expensive. But the ATP doesn’t reflect the “average” car.

That’s why CDK is using a new metric focused on the most popular cars in the country. Because, for the most part, these vehicles’ prices are growing slower than inflation. And by and large, they always have.

The average age of America’s fleet grows older because cars are simply made better but it’s also because more people are staying on the sideline from buying a new car. Perhaps they’re hesitating because the ATP number is all they hear about. Dealers and the media can use the CDK Affordability Tracker to better communicate real-world pricing to their customers and help them off the sideline.

How It Works

CDK has tracked the top 10 bestselling passenger vehicles* of 2025 sold at franchised dealerships (so no Tesla Model Y) according to automaker end-of-year sales results. The CDK average transaction price is calculated from CDK data with all dealer and automaker incentives included before taxes. We also break down the average sale price negotiated at the dealer and discount, but the average price is what’s being paid by customers and is calculated as similarly to ATP figures used in the industry as possible.

The top 10 bestsellers in 2025 were:

- Toyota RAV4

- Honda CR-V

- Toyota Camry

- Toyota Tacoma*

- Chevy Equinox

- Toyota Corolla

- Honda Civic

- Hyundai Tucson

- Ford Explorer

- Nissan Rogue

We’ve also taken the top four bestselling light-duty pickup trucks in the country to show the difference in one of the most popular segments and one that customers generally don’t cross-shop with passenger vehicles. These include:

- Ford F-150

- Chevrolet Silverado

- GMC Sierra

- Ram 1500

There are over 250 distinct models for sale in the U.S. These 14** made up 26% of all cars sold in the U.S. in 2025.

The Results

In December 2025, the average transaction price for the cars on the Affordability Tracker was $35,599.

In December 2025, the average transaction price for the cars on the Affordability Tracker was $35,599.

While $35,599 is a significant amount of money, it’s a figure that should seem more attainable than the $50,000-ish ATP. And it’s what the “average” buyer is spending. Somewhat surprisingly, that price is LESS than it was in December 2024, falling -0.2%, or $64. This is one of the key reasons why using a general ATP isn’t reflective of affordability for many car shoppers.

On the truck side, the arrow did move the other way, increasing 1.5% to $56,136.

On the truck side, the arrow did move the other way, increasing 1.5% to $56,136.

Now, the average price of a truck is still somewhat jarring at $56,136 but by focusing on light-duty trucks alone, this figure is still less than the ATP number given to all trucks including both midsize and heavy-duty. And like the typical ATP, popular high-end truck trims (such as the Ford Raptor or GMC Sierra Denali) move the average higher on our tracker. Truck pricing also has more variability than passenger cars in general. Buyers of all four models could be considering a $40,000 version while others are shopping for one that rings in at $70,000 or more.

Discounts

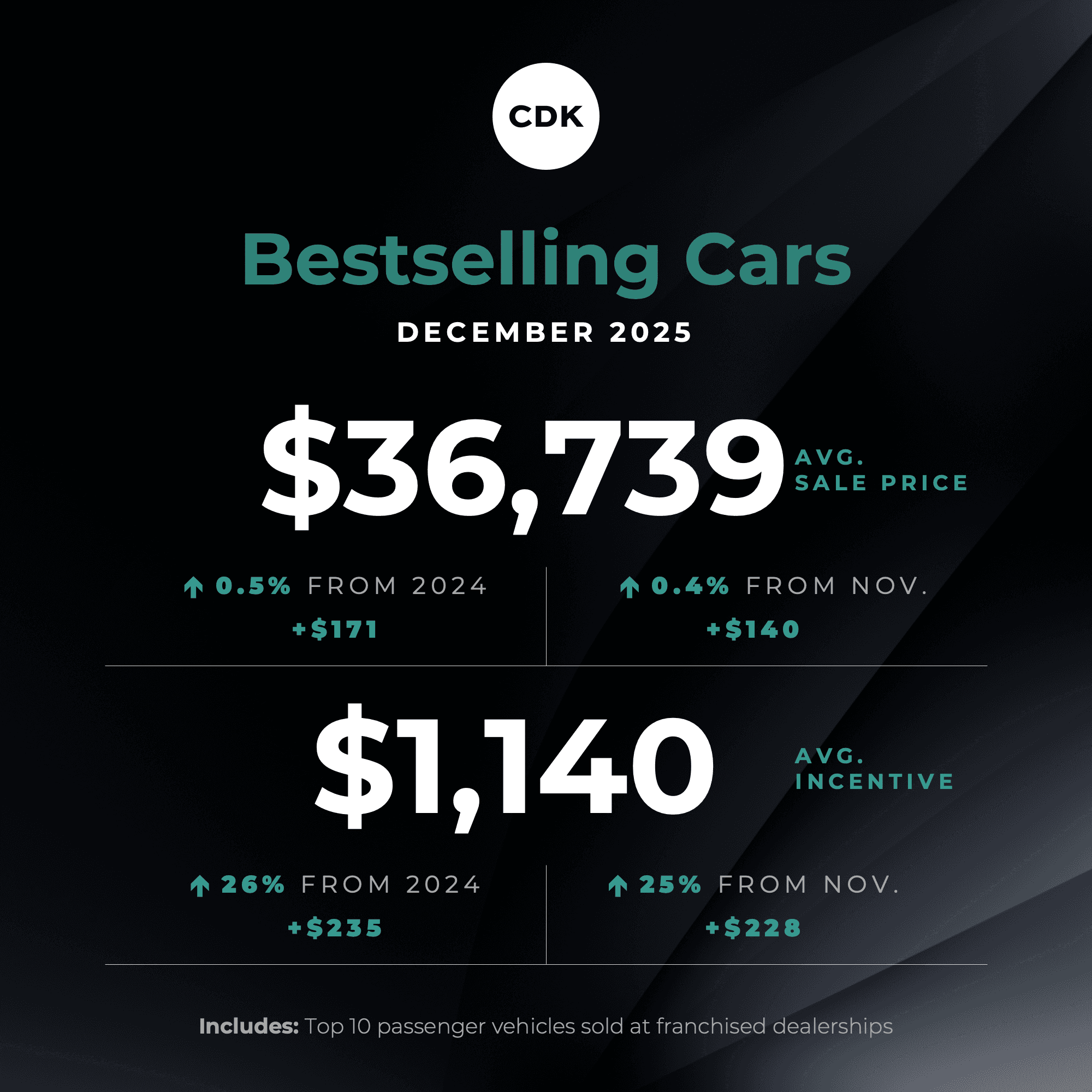

Average incentives for these 14 vehicles increased in 2025 but far more for passenger vehicles than light-duty trucks. This figure jumped 26% to $1,140, far offsetting the initial sales price, which was up 0.5%. This incentive is also far less than the national average because bestsellers generally don’t need a lot of cash on the hood to move them.

Light-duty truck incentives we tracked increased as well but at 7.4% to $4,399.

Moving Forward

Each month CDK will publish a new Affordability Tracker because even though these numbers are more achievable to many shoppers, they likely will rise in the coming months and years. Tracking how much average cars are selling for should be just as useful, if not more so, for mass market dealers as tracking the ATP.

* Clearly the Tacoma is a truck but because of its massive popularity, it seemed appropriate to include it as consumer trends are opting for rugged options across the board.

** Passenger cars listed included their hybrid counterparts, some sport trims, etc. Trucks were done similarly. Only electric versions were excluded. For example, the Chevy Equinox EV and the Ford F-150 Lightning aren’t included. But Toyota Corolla Hybrids and Ford Raptors are included.

Share This

David Thomas is director of content marketing and automotive industry analyst at CDK Global. He champions thought leadership across all platforms, connecting CDK’s vast expertise to the broader market and trends driving our industry forward. David has spent nearly 20 years in the automotive world as a product evaluator, journalist and marketer for brands like Autoblog, Cars.com, Nissan and Harley-Davidson.