4 Min Read • September 13, 2022

What Does Service Shopper 2.0 Reveal About Customers?

New Service Shopper 2.0 Study Reveals Shifts in Attitudes Around Providers

Dealers continue to face headwinds when it comes to luring service customers away from other providers. Service Shopper 1.0, a CDK Global research study conducted in 2020, shared vital statistics that revealed the gap between dealer expectations and consumer behavior, and provided insights for ways dealers could close the gap.

This year, we followed up with Service Shopper 2.0. In addition to reviewing how these expectations and behaviors have changed over the past two years, it also includes new findings such as how customers booked their appointment, the easiest and most difficult parts of their service experience, their driving habits, maintenance philosophy and many other behavioral factors that help provide dealerships valuable information that can lead to higher retention rates. It also includes valuable data on vehicle type such as EVs.

So, what are some of the things we found out?

Downward Trend in Scores and Visits

The most significant finding was that since our last survey, Net Promoter Scores (NPS) were down for everyone in 2022. Independent Repair facilities took the biggest hit with scores plummeting from 63 to 49, which puts them much closer to dealers (at 44) and chains (at 43).

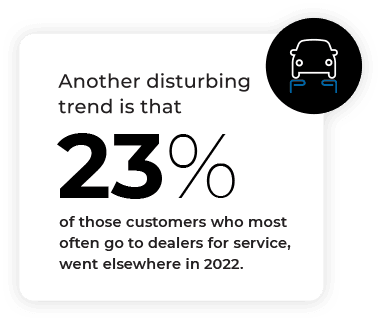

While this creates a more level playing field, the fact remains: customers continue to look outside the dealership for service.

One major reason is inflation, which is at levels we haven’t seen in more than 30 years. Even though loyalty numbers remain the same and customers say they prefer going to the dealership for service, it’s no surprise when they switch. High prices and the perception of needlessly being upsold continues to drive them to less expensive alternatives.

What can you do to change that?

“I would be more likely to visit if they were cheaper and faster.”

Don't Just Say You Value Their Business, Show Them

Loyalty programs or "friends and family" discounts would address the price concerns and motivate customers to visit the dealership for service. A little incentive can go a long way in driving customers back to your dealership.

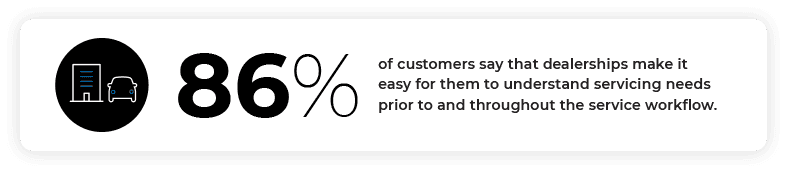

Also, if customers need additional service work, they want to know why. So it's important that you show them — literally. The Service Advisor or Tech should be transparent and detailed about why the additional charge is warranted. Texting customers photos and videos of what needs to be done helps build trust and removes their suspicion of being needlessly upsold.

What Are the Consequences of Fewer New Cars on the Market?

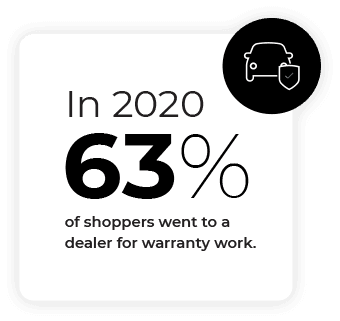

New car sales are down 10% to 15% over the past two years. Many people are holding onto their cars longer, which means that the cars they bought new are no longer under warranty. Customers who aren’t under warranty go elsewhere for service, while those under warranty generally look to dealers for their OEM expertise. But not always.

Combined with the fact that the first seven years of a car’s life is the sweet spot for dealership service and visits decrease after that, and these shifting trends are more alarming. Dealers need to be proactive to stay in the consideration set.

But these indicators show dealers can still build their service base:

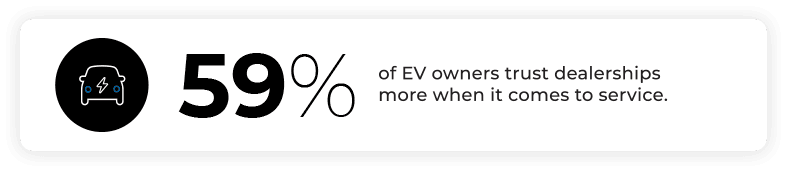

The growing popularity of Electric Vehicles (EV) is another opportunity. The unique nature of an electric powertrain, and its newness on the market, has owners concerned about who lays their hands on its precious internal mechanisms.

What Can You Do To Attract New Service Customers and Win Back Those Who've Left?

The Service Shopper 2.0 research shows that dealerships are viewed as customer-centric, while chains are considered convenient, and independent shops trustworthy. Incentivizing customers is just one way to win their business. Here are a few more ways dealerships can play to their strengths and improve their perception in other areas.

Maximize Creature Comforts

Nearly half (47%) of customers surveyed said they prefer to wait for their vehicle to be repaired. Customer lounges with Wi-Fi, work areas, and snacks and beverages (coffee makers and vending machines) are top motivators.

Provide Current and Future Service Needs

The most frustrating part of the service experience for customers across all service providers is not understanding what their future service needs will be. CDK can help dealerships provide real-time service updates and assist technicians in identifying current and future service needs.

Power Up EV Positioning

59% of EV owners trust dealerships more than other providers, so as the EV market grows, so does the opportunity for dealers. Since EV technology is still perceived as a specialty repair, it’s important to market that your dealership is equipped with the expertise and technology EV customers need.

Boost Your Online Presence

Reputation matters — especially among Gen Z. One of the best ways to build up your reputation is to encourage satisfied customers to go online and review their service experience.

For a more in-depth look at the data and learnings that can help you attract and keep more Service shoppers, tune into the Fixed Ops Forum.

Share This