3 Min Read • November 1, 2023

Unexpected Inventory Boosts Lead to Improved Purchase Experience

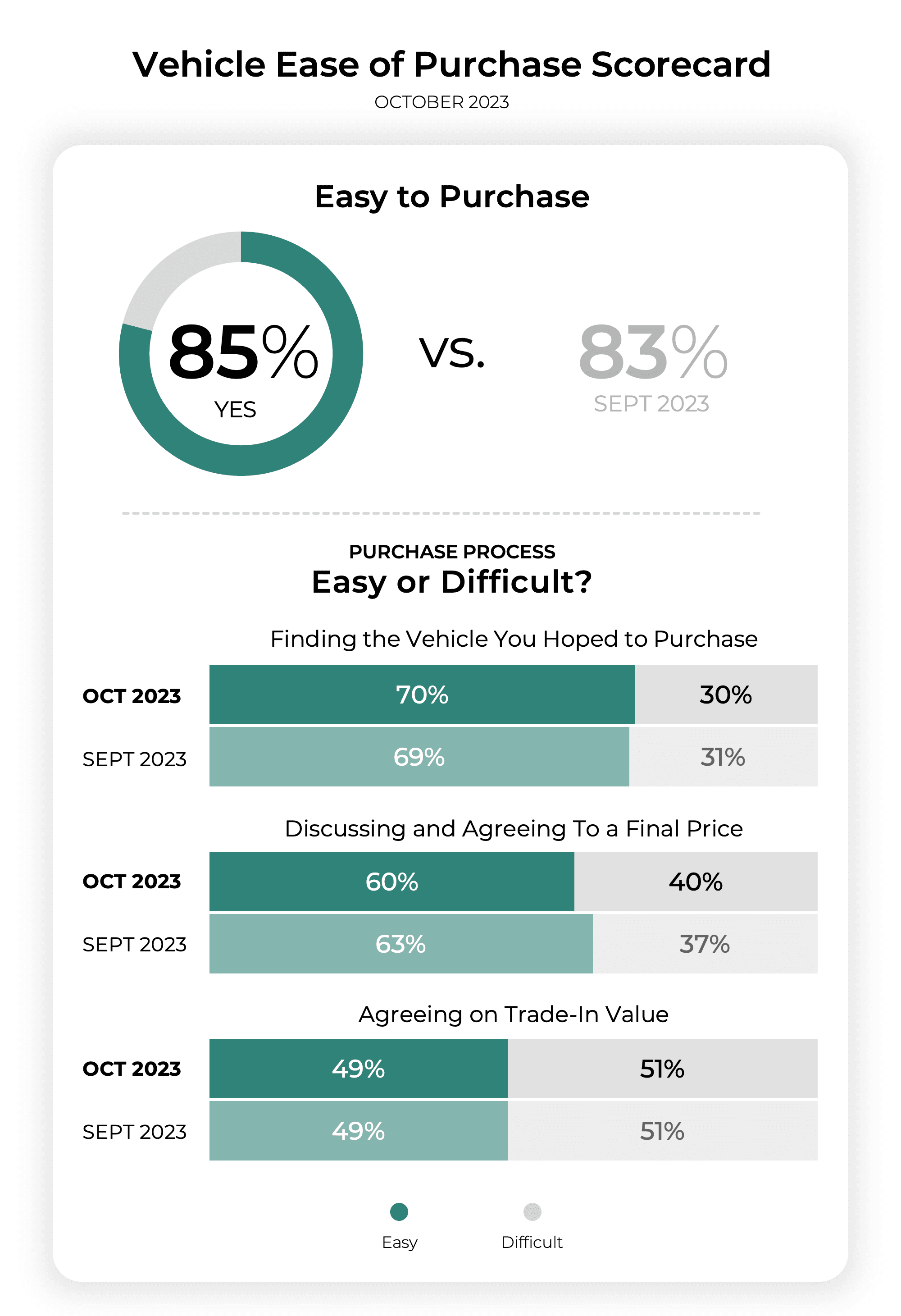

Consumer credit continues to tighten. The workforce unrest for the Detroit automakers is just now settling. And for many, the model year is turning over. Yet, none of these factors dented how smoothly car sales transacted in October. The CDK Global monthly Ease of Purchase score ticked to near its highest level, 85%, up from 83% in September as more buyers found the car they wanted in stock.

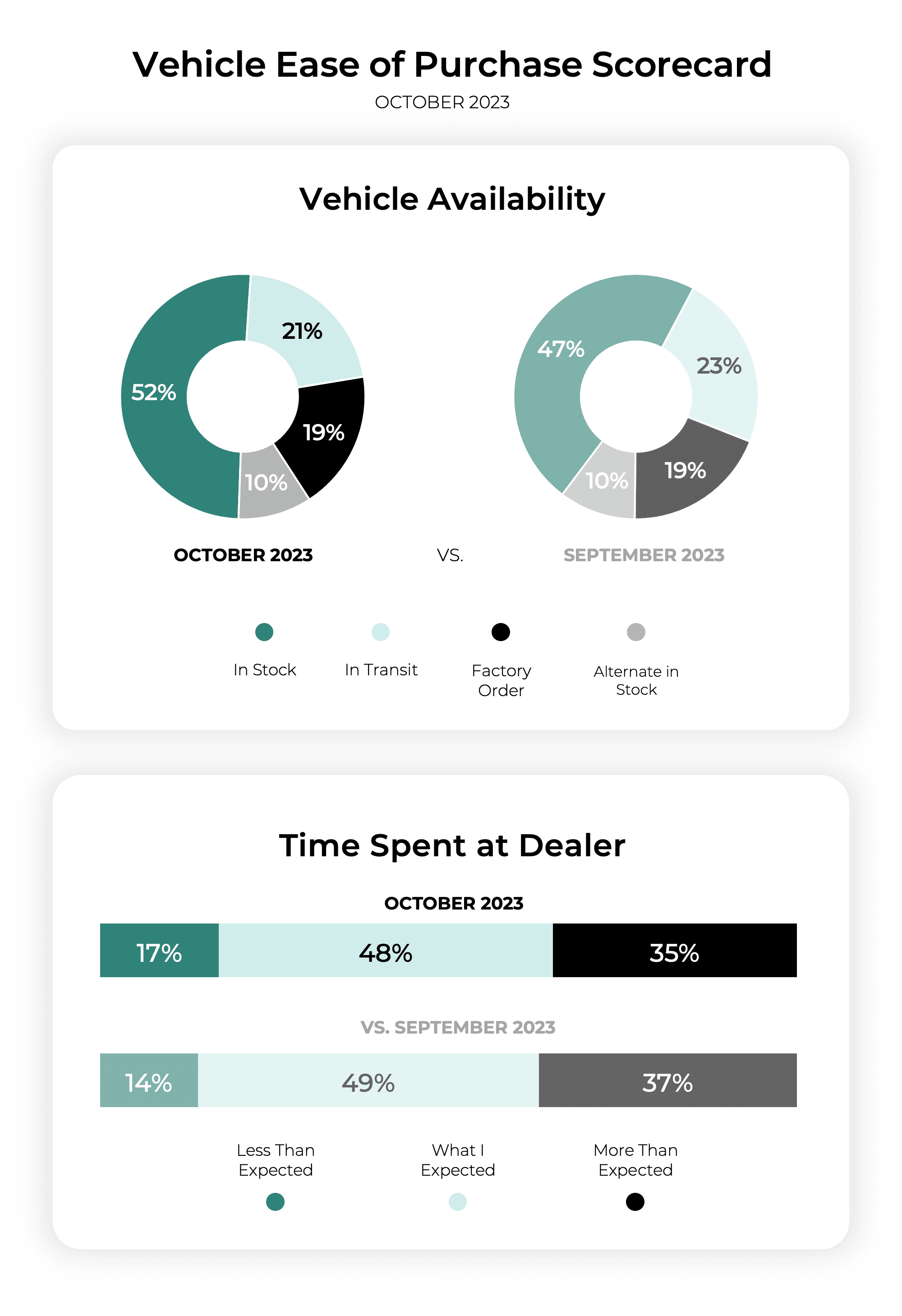

Despite many factories going dark due to the labor issues crossing the country, inventory levels at dealers are still quite high. That led to 52% of buyers finding the car they wanted in stock, up sharply from September at 47% and last October at 44%. This one factor, a car buyer locating the car they want to buy at the dealer, generally correlates to a higher overall Ease of Purchase score in our survey, which was once again true in October.

Despite many factories going dark due to the labor issues crossing the country, inventory levels at dealers are still quite high. That led to 52% of buyers finding the car they wanted in stock, up sharply from September at 47% and last October at 44%. This one factor, a car buyer locating the car they want to buy at the dealer, generally correlates to a higher overall Ease of Purchase score in our survey, which was once again true in October.

CDK researchers took a deeper look by brand and despite the ongoing labor stoppages at various plants, just as many buyers of key domestic brands found what they wanted in stock when compared to import brands not impacted by work disruptions.

Healthier inventory levels also limited the number of dealerships a buyer visited to complete their purchase. Last October, 30% of buyers visited three or more dealers. That number fell to 26% this October. Conversely, nearly one in three buyers (30%) bought their car after visiting just a single dealership, up from 25% last October.

And while more cars on lots helped make taking the test drive easy (80% in October versus 74% in September), the dollars and cents aspects of the purchase process were much thornier. Whether it was agreeing to the final price (60%), applying for credit (61%) or completing the finance process (61%), all dropped from September and remain some of the areas where the fewest respondents said it was easy for them.

And while more cars on lots helped make taking the test drive easy (80% in October versus 74% in September), the dollars and cents aspects of the purchase process were much thornier. Whether it was agreeing to the final price (60%), applying for credit (61%) or completing the finance process (61%), all dropped from September and remain some of the areas where the fewest respondents said it was easy for them.

Agreeing on the value of a buyer’s trade-in remained flat at 49% but continues to be the worst performing area for buyers and was down from 53% last October. It’s unclear why this is so much lower than agreeing on the final price. It could be due to wildly fluctuating used car prices generating word-of-mouth stories of tremendous payouts for friends and family driving up expectations of those we surveyed when they met reality at the dealership. And while there are some online tools that help shoppers estimate their trade-in value, they generally do sway to the higher end of the spectrum.

The work stoppages might not impact inventories in the long term and in the here and now it seems to have had little impact on buyers. The most concerning area for dealers remains the financial aspect of the deal. If there are steps to address the trade-in process specifically, that would make a significant impact on the overall experience.

Share This

David Thomas is director of content marketing and automotive industry analyst at CDK Global. He champions thought leadership across all platforms, connecting CDK’s vast expertise to the broader market and trends driving our industry forward. David has spent nearly 20 years in the automotive world as a product evaluator, journalist and marketer for brands like Autoblog, Cars.com, Nissan and Harley-Davidson.