3 Min Read • September 25, 2023

Buyers Have Harder Time Finding Cars In Stock in September

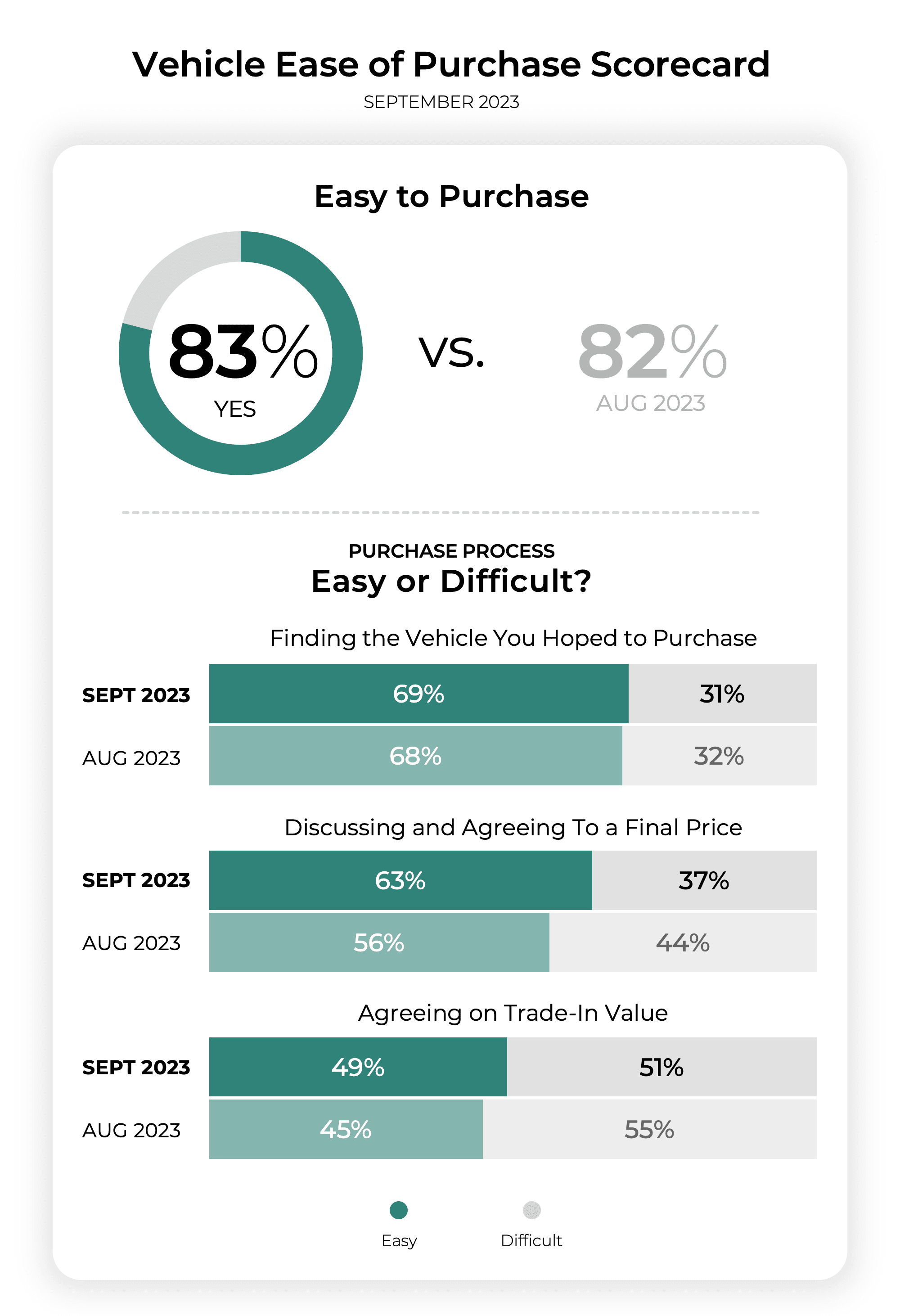

As inventory worries start to resurface alongside labor difficulties, car buyers still found it relatively easy to buy a new car in September. In our monthly survey, 83% of new car buyers said the overall process of buying their vehicle was easy. That’s up from 82% last month and close to the average we’ve seen since our tracking started in July 2022.

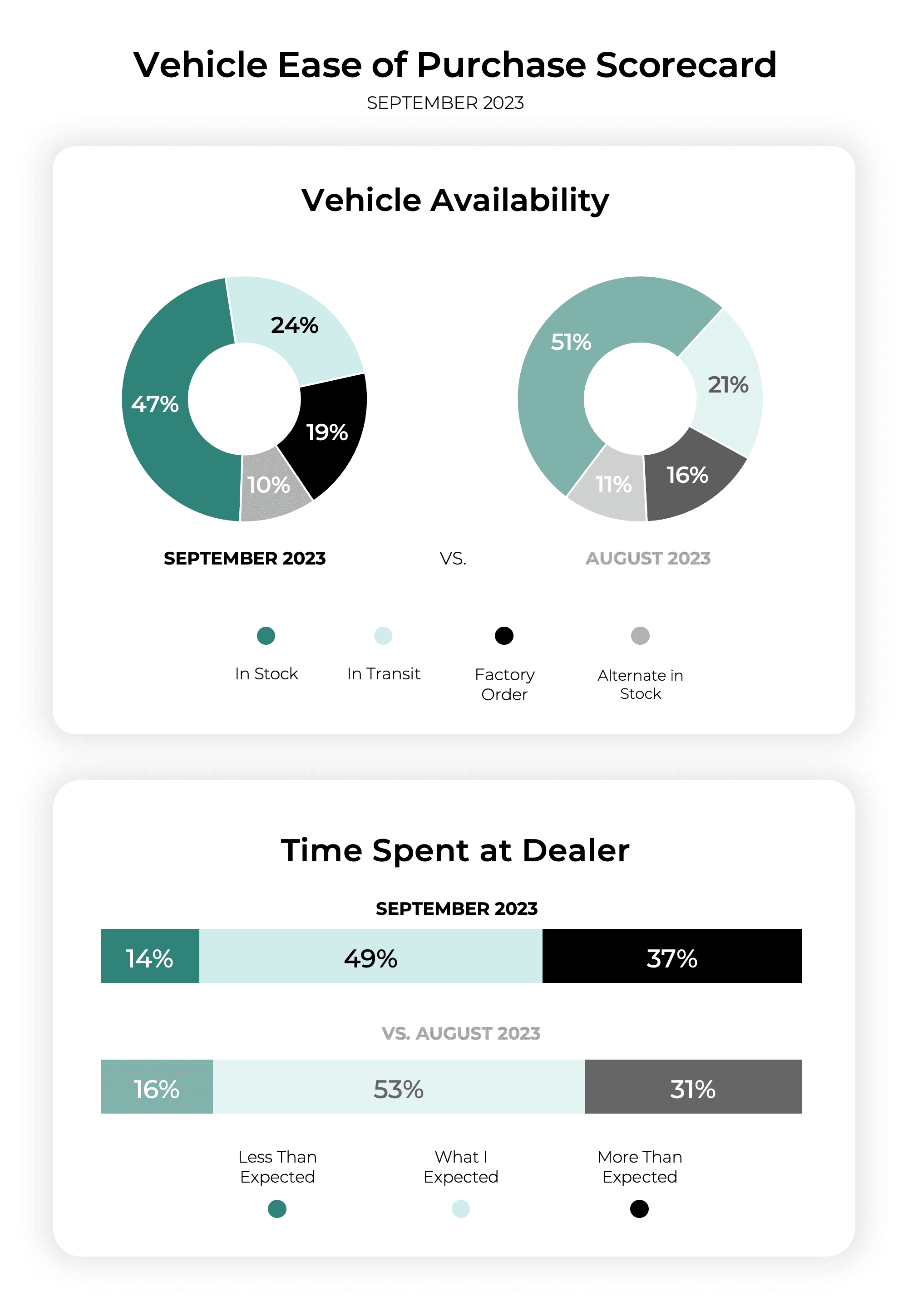

That figure should be seen even more positively as the number of people who found the car they eventually purchased in stock, dropped from 51% in August to 47% in September. And this data was collected before any worker picked up a sign for a picket line.

That figure should be seen even more positively as the number of people who found the car they eventually purchased in stock, dropped from 51% in August to 47% in September. And this data was collected before any worker picked up a sign for a picket line.

That 47% number is still relatively high compared to the previous 12-month average, but the erosion of recent gains paints a murky picture. More buyers had to resort to buying a car in transit — 24% in September versus 21% in August — and ordering from the factory — 19% versus 16% in August.

Shoppers not finding what they wanted in stock was prevalent when supply chain issues constrained production last year, but this month’s drop didn’t have a clear cause. With labor issues already shutting down select assembly and supplier locations throughout the U.S., inventory for many brands will likely fall for the remainder of the year. And it’ll shift more demand to brands not directly impacted by the strikes, making their inventory more valuable.

This drop in inventory for September made it harder for buyers to take a test drive and that step saw the biggest decline in terms of being “easy,” falling from 83% in August to 74% in September.

Luckily, the thorniest steps in the buying process all saw gains in September.

Nearly two out of three buyers or 63% felt agreeing to the final price was easy, up significantly from 56% in August, which is the second highest number we’ve recorded. Similarly, more people found the process of applying for credit easier than it’s been in recent months with tightening forces working across the economy. There too 63% of buyers agreed it was easy to secure credit, up from 58% in August and right in line with the average from the previous year.

However, only 49% of buyers thought agreeing to the value of their trade-in was easy. Now, that was up from 45% in August but is below the average and for the third straight month fell under 50%. This is likely due to continued volatility in the used car market, which has a direct impact on trade-in values and one that an average consumer isn’t tracking as closely as those working in a dealership.

These gains on the negotiation and financing end of the purchase process didn’t, unfortunately, reduce the amount of time buyers experienced at the dealer. More than a third or 37% of buyers thought it took longer than expected to get out the door in their new vehicle, up from 31% in August. The lack of inventory and difficulties in getting behind the wheel for a test drive likely led to this figure erasing the improvements from August and in the second quarter of 2023.

These gains on the negotiation and financing end of the purchase process didn’t, unfortunately, reduce the amount of time buyers experienced at the dealer. More than a third or 37% of buyers thought it took longer than expected to get out the door in their new vehicle, up from 31% in August. The lack of inventory and difficulties in getting behind the wheel for a test drive likely led to this figure erasing the improvements from August and in the second quarter of 2023.

Predicting what the past and next few weeks will mean for car buyers is difficult. Future Ease of Purchase surveys should be able to provide a meaningful tie from work stoppages to the car buying experience.

Share This