3 Min Read • November 14, 2023

Who’s Paying Cash for Cars?

Sky-high interest rates and tightening credit have made buying a new car more daunting than it’s been in years. It comes at an unfortunate time when inventory on lots is looking better than at any time since the pandemic. And it’s made people rethink how they’re financing this very large purchase.

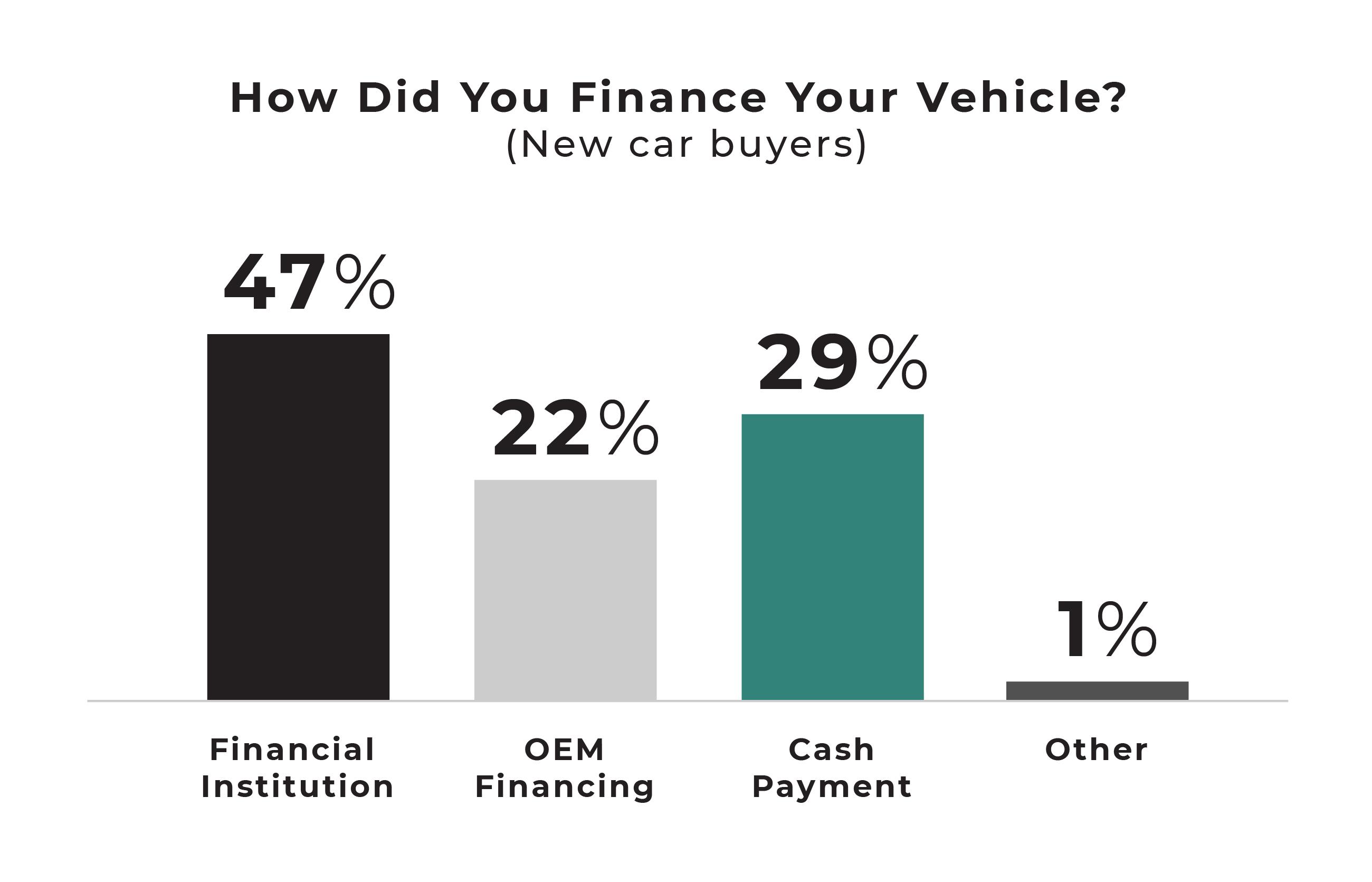

In a recent survey, CDK Global asked approximately 1,000 new car buyers how they financed their purchase. Nearly three out of 10, 29%, paid in cash.

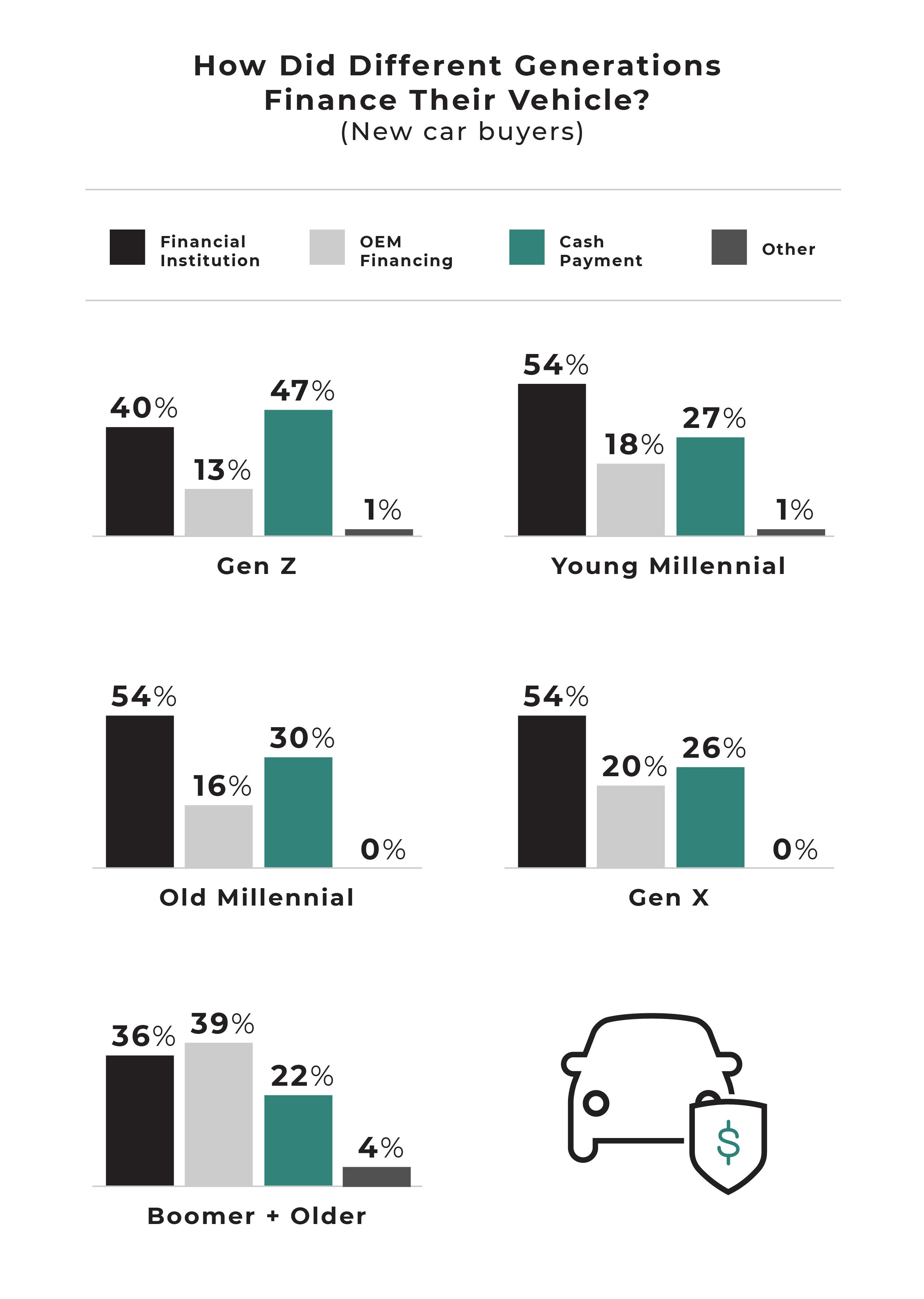

So, who exactly is paying for the full cost of a car upfront at the dealership? The answer might surprise you. By far the biggest group paying cash for a new car or acquiring one as a gift is Generation Z.

So, who exactly is paying for the full cost of a car upfront at the dealership? The answer might surprise you. By far the biggest group paying cash for a new car or acquiring one as a gift is Generation Z.

While a year of staying home due to pandemic lockdowns led to savings for down payments and cash purchases, this digital-first generation is still low on cash and high on stress.

While a year of staying home due to pandemic lockdowns led to savings for down payments and cash purchases, this digital-first generation is still low on cash and high on stress.

Gen Z, or Zoomers, who ascended to adulthood after 9/11 and the Great Recession has earned the label of being “the most stressed-out generation.” Political upheaval, multiple wars and now record-high-inflation are all unprecedent economic events that impacted the economy and have caused America’s youngest generation to adopt frugal spending habits. Zoomers have grown up with the convenience of ride-sharing but it’s not always a cheaper option.

Evidence points to Gen X parents of Zoomers covering auto expenses — from down payments to car loans — even though it’s putting them in financial dire straits. One Bankrate report found 7 in 10 (68%) of parents have or are making financial sacrifice like tapping into emergency savings, retirement funds and prolonging debt payoff to financially support their kids.

Despite the fact that Zoomers are joining the workforce by the tens of millions with nearly $3 trillion in purchasing power, their parents are dipping into their savings to help bankroll car loans for Gen Z adult kids who are strapped for cash due to the tight job market, low-paying jobs and income interruptions, like layoffs, that have become so common in recent years.

CDK found that while Gen Z has the same purchasing desires as millennials, they don’t share the same purchasing power. Gen X buyers are more likely to finance a car due to higher credit scores while Gen Z are less likely to finance a car because most are skittish of credit cards that lead to debt so they’re shopping for less expensive vehicles.

There are benefits to paying for a car in cash like no interest or loan fees, no monthly payment and dealer discounts. But on the flip side, a cash car payment can mean fewer inventory options, less savings, no dealer incentives and no financing options or credit gains.

With the average car price hovering at more than $45,000 plus interest rates averaging between nearly 8% and 13%, Zoomers are nickel and diming their finances more than ever and experts don’t anticipate the Fed to lower rates until 2024.

Share This

Courtney has provided editorial support to domestic and international automotive brands over the last 20 years and is committed to educating dealers on ways they can boost their business operations to deliver the best customer experience.