3 Min Read • March 18, 2024

What Does Gen Z Want in F&I Products?

Generation Z is coming of age and beginning to slide into the driver’s seat. While this generation follows those that precede them in prioritizing price as the biggest motivator for what car to buy, they follow their own path when it comes to protecting this very large purchase. And that difference can influence how F&I Managers provide value to these young buyers.

In a recent survey, CDK asked over 1,200 car buyers how many and what F&I products they purchased. Gen Z collectively bought one to two products, but they didn’t buy what you may expect.

For example, few bought scheduled maintenance, a product that makes sense for young vehicle owners who may not have cash on hand and can instead wrap the cost of future service bills into a financing package.

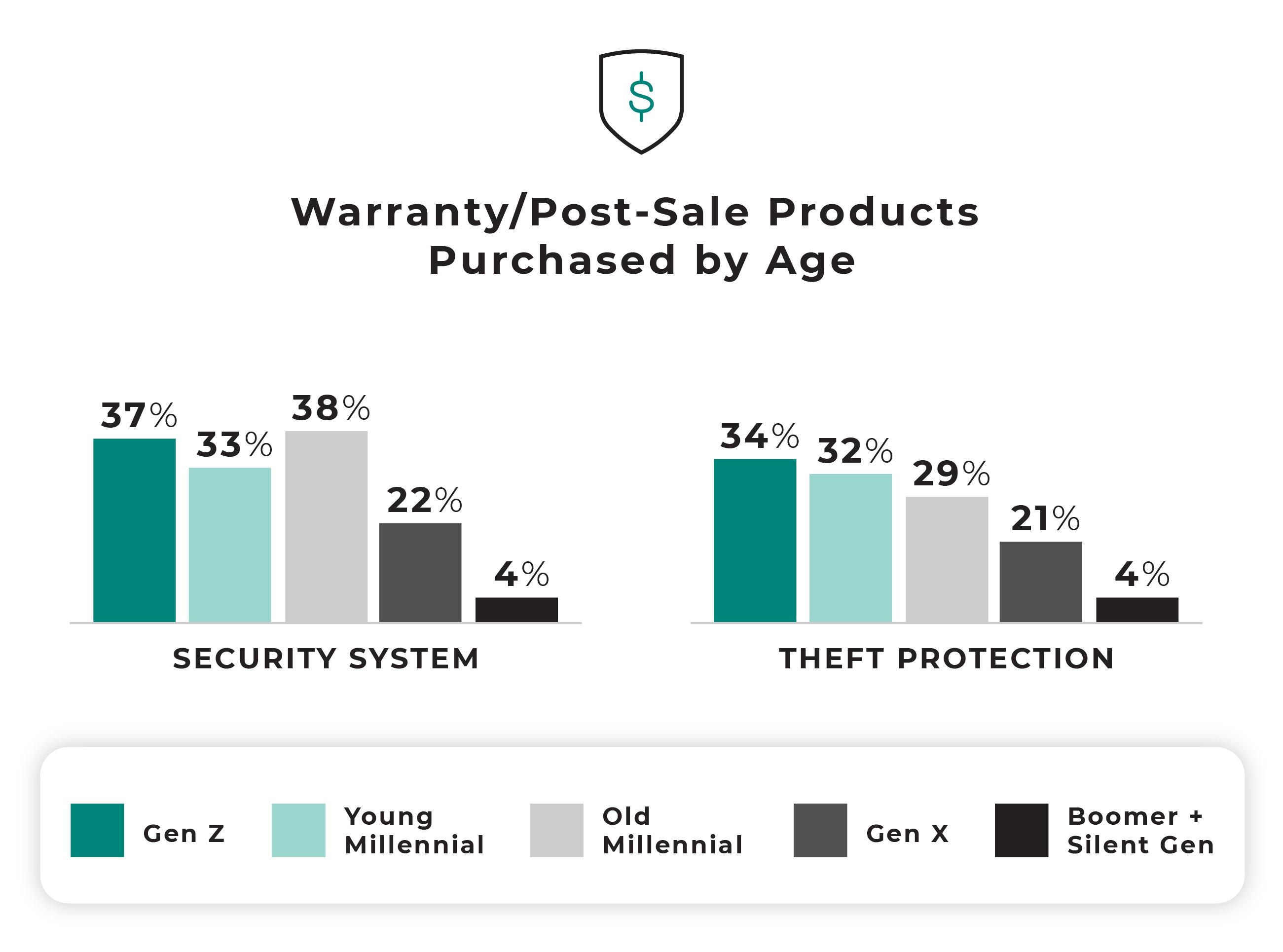

Instead, Gen Z collectively purchased products to guard against crime. Nearly four out of 10, 37%, bought a security system, while 34% purchased theft protection. These selections outpaced most of their generational counterparts from Millennials to Boomers.

Gen Z, often considered to be born in the late 1990s and early 2000s, was in line to inherit a strong economy with record-low employment. Then COVID-19 hit. Instead of looking ahead to a world of opportunities, Gen Z now peers into an uncertain future marked by stubborn inflation, multiple wars and an increase in crime rates tied to the pandemic.

Despite the fact that many crime rates are returning to pre-pandemic levels, a new study from the Council on Criminal Justice reports motor vehicle thefts increased 29% in 2023, and have increased by 105% since before the pandemic. Much of that increase is likely driven by thefts of Kias and Hyundais, which were targeted after viral videos pointed out security flaws that made certain models easy to start without a key fob.

The same study reported a decrease in carjackings by 5% from 2022 to 2023, but that rate is still much higher than before the pandemic. Experts point out that they don’t have a lot of data on carjackings as historically those haven’t been tracked as a stand-alone crime. But due to high visibility in the media, there may be a perception that this crime is out of control across the nation.

Some cities have a real and significant problem with vehicle crimes but Gen Z, who spend more time using social media overall than any other generation, may see and read more about these crimes and perceive more danger. At the same time, Gen Z is flocking to the five largest U.S. cities, which have more crime, and vehicle theft overall, likely influencing their decision to buy theft protection products.

Update Your F&I Selling Techniques for Gen Z

With average car prices still historically high and elevated interest rates pushing them even higher, Gen Z buyers are smart to want to protect this large investment from theft. F&I Managers eager to address the concerns of younger buyers would do well to highlight anti-theft and security products early in their F&I presentations.

However, be wary of overwhelming buyers with too many products in an effort to pump up profits and performance metrics. CDK found that when buyers are presented with one to two products by the F&I Manager, nearly half, 49%, of buyers purchased those products. That number dropped steeply as more products were introduced, bottoming out at only 1% purchasing more than six products when that number was presented.

The sweet spot for Gen Z was one to two products, so it makes sense to highlight security and theft protection first to appeal to what younger buyers value and want today.

Share This

Jason is the F&I Product Marketing Manager for CDK Global’s Modern Retail portfolio, orchestrating the launch of multiple solutions to help dealers meet the needs of customers in this ever changing market. This includes the signing experience as well as the processes to move the F&I office into a fully digital workflow. He is responsible for the coordination between CDK customers and our product teams to improve the F&I experience for both dealers and car shoppers.