2 Min Read • December 5, 2023

More Car Buyers Visit Just 1 Dealership in November

Last month, higher inventories led to more people finding the car they wanted in stock and, at the same time, more car buyers in our Ease of Purchase survey said it was, in fact, easy to buy a car. In November, we saw a quick reversal.

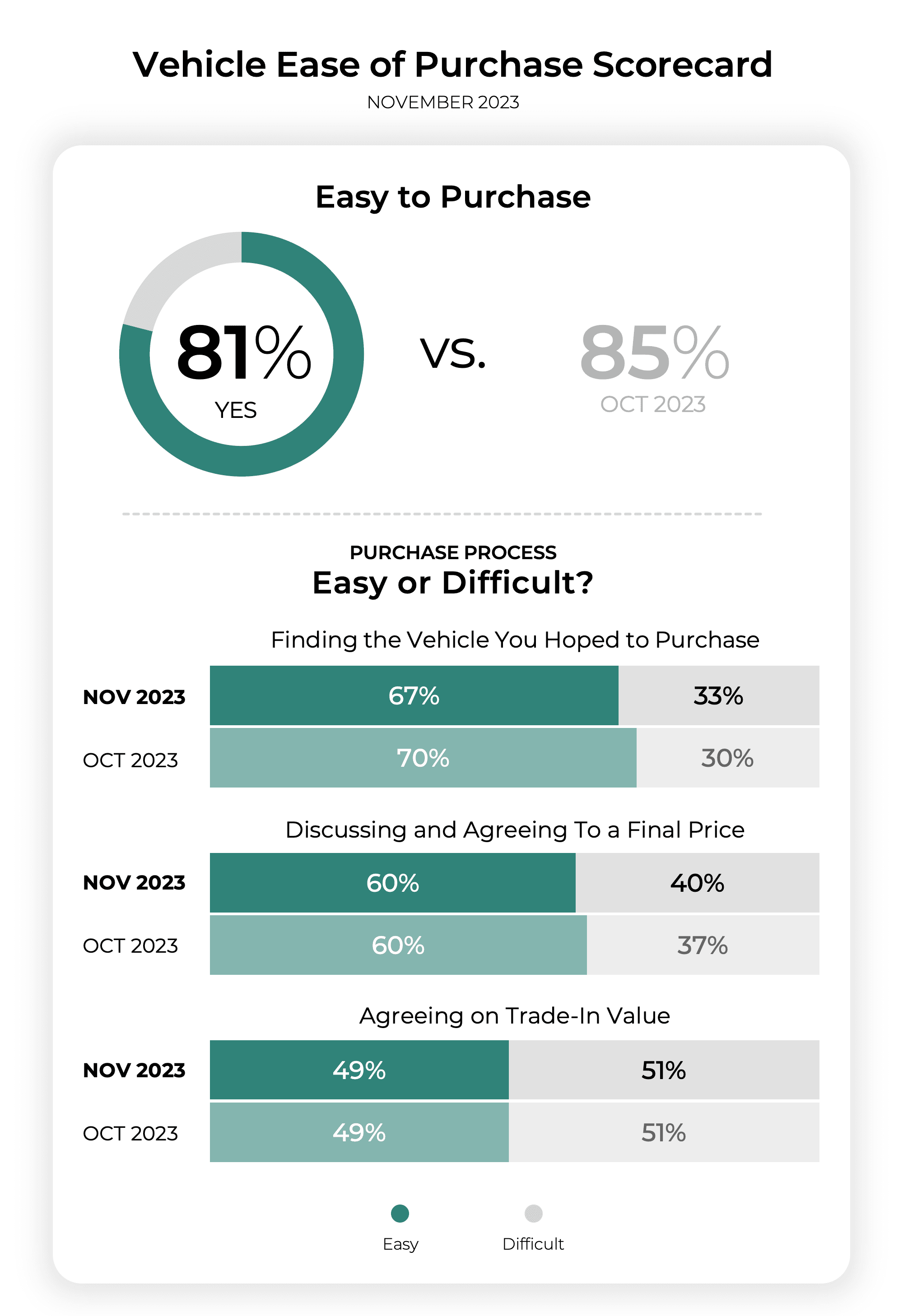

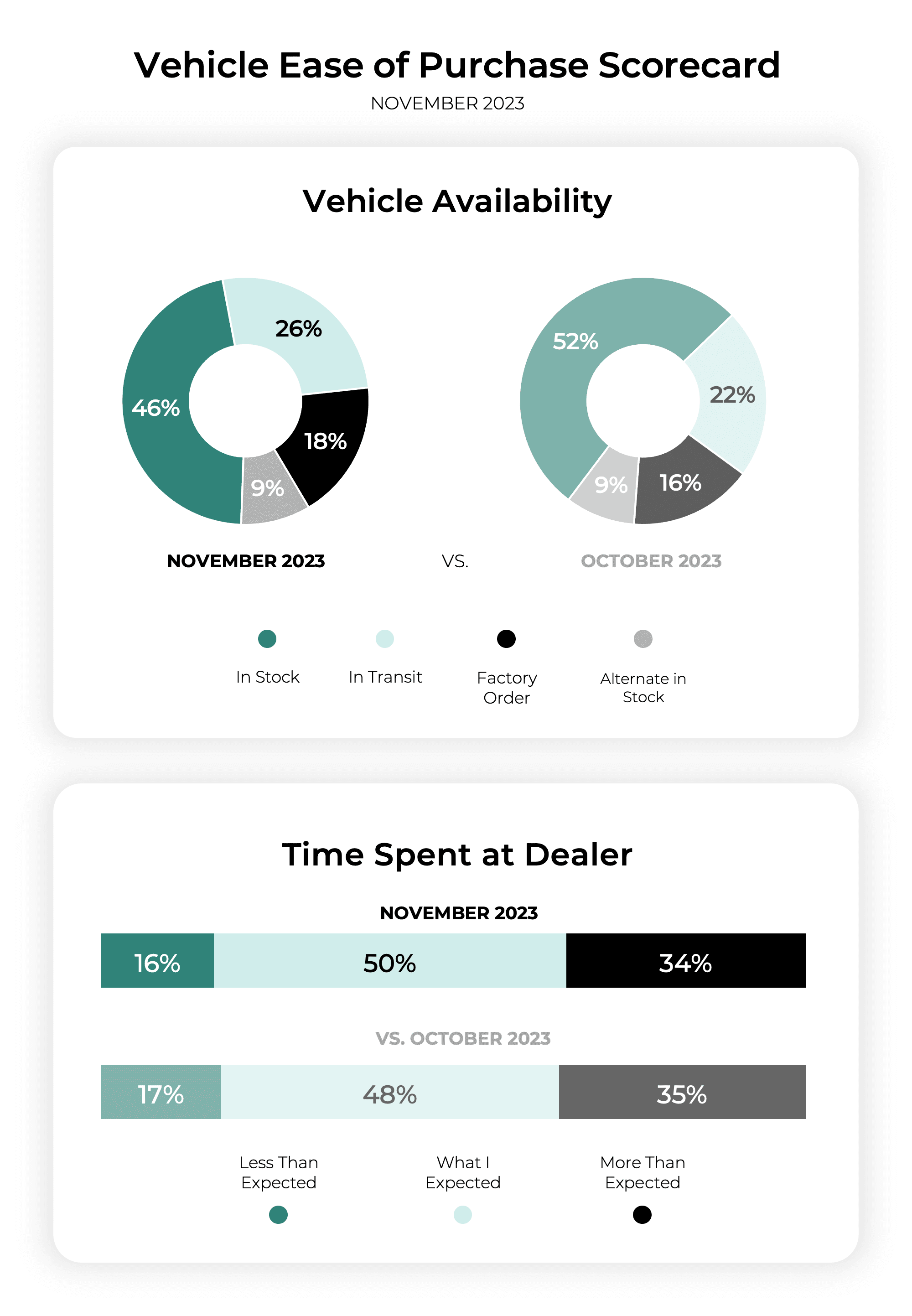

While national inventories remained high, up compared to 2022, far fewer buyers found the car they wanted in stock (46%) compared to October (52%). We've found that this single factor generally correlates with a lower overall Ease of Purchase score, and that remained true again with 81% of buyers in November saying the process was easy compared to a significantly higher 85% in October.

There's one substantial change that may explain this quick downward shift despite higher inventories on a national level.

More than a third of buyers (35%) visited only a single dealership to complete their purchase, up sharply from 30% in October. This would limit the wider inventory pool of even visiting a second dealership, which 40% of buyers did in November compared to 44% in October.

More than a third of buyers (35%) visited only a single dealership to complete their purchase, up sharply from 30% in October. This would limit the wider inventory pool of even visiting a second dealership, which 40% of buyers did in November compared to 44% in October.

Another area that correlates to the overall Ease of Purchase score and finding an in-stock car is how many people say it was easy to take a test drive. Like those other scores, this also took a hit in November falling to 76% from 80% in October.

Financial aspects of the purchase process continue to be a sore spot and that hasn't changed in several months. Agreement on trade-in value remained flat for the third month in a row with just 49% saying it was easy. Agreement on a final price also stayed flat at 60% while applying for credit only got slightly easier at 63% in November compared to 61% in October.

When we looked at the survey respondents' comments who said they had a negative experience, more than a few stressed that the process simply took too long. One even called the time waiting "ridiculous." But 50% of buyers said the amount of time was what they expected up from 48% in October. Those saying it took more and those who said it took less fell one percentage point each. More buyers in November (78%) also said the salesperson made efficient use of their time compared to 76% in October.

When we looked at the survey respondents' comments who said they had a negative experience, more than a few stressed that the process simply took too long. One even called the time waiting "ridiculous." But 50% of buyers said the amount of time was what they expected up from 48% in October. Those saying it took more and those who said it took less fell one percentage point each. More buyers in November (78%) also said the salesperson made efficient use of their time compared to 76% in October.

Perhaps it's the sheer amount of shopping in November that sent more buyers to a single store, looking to knock out one more item off their list. As we move into December, end-of-the-year deals could sway buyers to shop around and visit more than just one dealership to secure the car they want.

Share This

David Thomas is director of content marketing and automotive industry analyst at CDK Global. He champions thought leadership across all platforms, connecting CDK’s vast expertise to the broader market and trends driving our industry forward. David has spent nearly 20 years in the automotive world as a product evaluator, journalist and marketer for brands like Autoblog, Cars.com, Nissan and Harley-Davidson.