2 Min Read • November 13, 2025

High Interest Rates Hampered Half of Car Shoppers

Slowly but surely interest rates at the federal level and at dealerships are starting to come down. Affordability is that key word for so many of today’s shoppers but it’s been hard to quantify just how many potential car buyers were kept on the sidelines due to high interest rates.

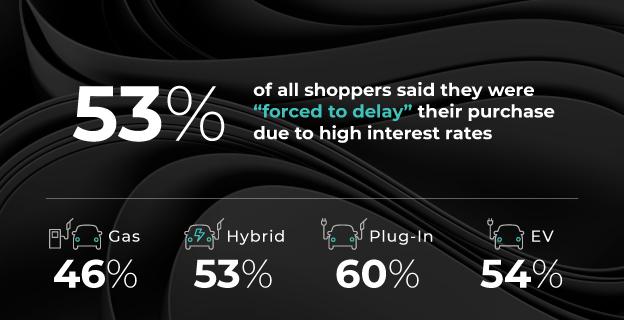

In new research of over 1,300 in-market car shoppers, CDK found that over half said they’d delayed their purchase due to high interest rates.

Yes, 53% of car shoppers had just been waiting for those rates to drop to start their purchase journey.

The survey also asked what types of powertrain people were shopping for: gas, hybrid, plug-in hybrid or fully electric. Interestingly enough, more plug-in (59%) and EV shoppers (62%) said they waited on the sidelines than gas (46%) and hybrid (52%).

From November 2024 to November 2025, the Effective Federal Funds Rate (EFFR) has fallen almost exactly one percentage point from 4.83% to 3.86%. It’s also the lowest since December 2022. However, the federal rate isn’t directly related to car loan interest nor how quickly it rises or falls. According to Edmunds, the average new car interest rate fell almost half a percentage point in the past six months from 7.3% in May to 6.9% in October and more rate cuts are expected by the end of the year.

If this recent group of car shoppers is a leading indicator, there may be more people on the sidelines waiting to enter the market as rates keep falling. It also suggests automakers should continue to offer incentivized interest rates or increase their use compared to other incentives. Dealers should also continue to promote the latest incentivized rates to capture this faction of potential buyers.

Share This