3 Min Read • November 11, 2025

Gen Z’s Preferences in the F&I Office in 2025

Born between 1997 and 2012, Generation Z already makes up 25% of the global population and is likely to be the largest generation ever, according to NielsenIQ. Raised with the internet at their fingertips and social media embedded into their coming of age, they bring a new set of expectations, needs and preferences to the dealership. While their current buying power is modest, it's projected to reach $12 trillion by 2030, positioning them to become the wealthiest generation in history. That kind of economic force means dealers can't afford to misunderstand them.

CDK recently published the 2025 F&I Shopper Study, which looks at this vital part of the dealership. And while that report covered all dealership customers, there were areas around how Gen Z approaches the dealership differently from its predecessors, particularly in the F&I office. Here's what we found:

Gen Z Buys More

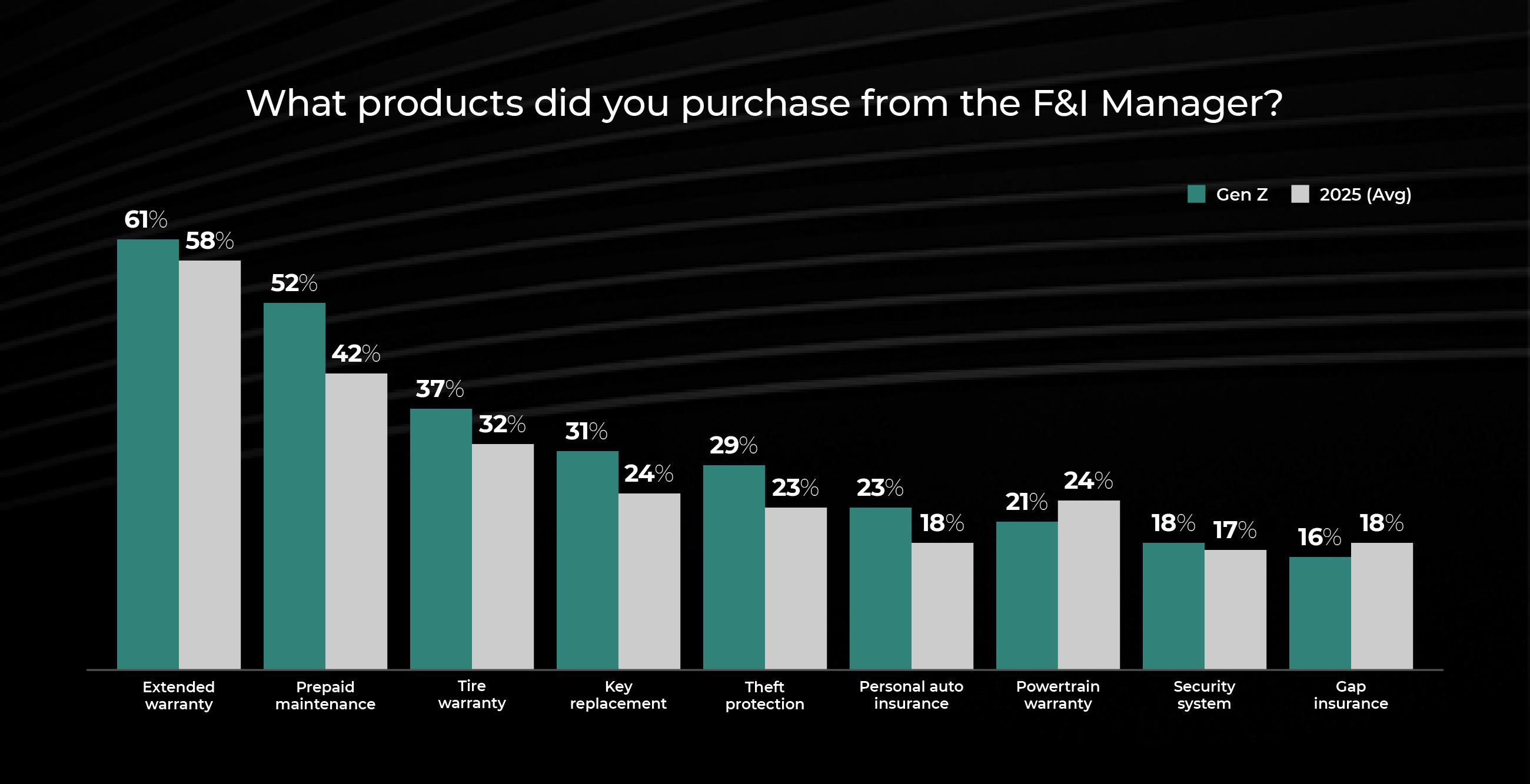

Not only is Gen Z the most likely to buy an F&I product, but they’re also the most likely to buy six or more products by a ratio of 2:1. We saw the most popular F&I products — extended warranties and prepaid maintenance — make big leaps this year for all buyers, moving from 39% to 58% and 34% to 42%, respectively. But the numbers were even higher for Gen Z F&I buyers, with 61% selecting extended warranties and 52% selecting prepaid maintenance.

Security Sells

While extended warranties and maintenance plans gained significant interest across generations, Gen Z stands out for its interest in security and theft protection products. They're more likely than older buyers to purchase these protections, perhaps reflecting a more urban living pattern, higher awareness of theft through social media, or just a more practical approach to protecting what's likely their biggest purchase to date. The gap when it comes to theft protection is especially great with 29% of Gen Z selecting it compared to the 23% average.

Some dealers may assume today's built-in vehicle technology makes theft protection and security systems an afterthought. Data from Gen Z shows the opposite. Dealers who lean into security products when presenting F&I options to younger buyers will find them more receptive than most generations.

Financing Outside the Dealership

When it comes to financing, Gen Z breaks from tradition. Among those who financed their vehicle, Gen Z was the most likely to secure financing through outside institutions at 69% compared to a 68% average and considerably higher than the oldest baby boomer generation at 58%. This could indicate Gen Z does more research ahead of time and compares rates online. Or that they have an existing relationship with a bank that makes financing through them easier than through OEM or dealer-sourced financing.

Dealers should be prepared for Gen Z buyers to enter the showroom with financing already in place. To compete, emphasize any exclusive benefits your dealership can offer. Additionally, ensure financing options are presented transparently and clearly, as CDK found that Gen Z customers were the most likely to feel overwhelmed during their interactions with the F&I Manager.

Gen Z Still Signs by Hand

Despite their reputation as digital natives, 53% of Gen Z customers actually prefer signing documents on physical paper. In fact, millennials and Generation X are more likely than Gen Z to prefer a digital-only process. Yes, Gen Z shares more in common with boomers in this regard. With that said, Gen Z leads the way in preferring a hybrid approach — one in four prefers a mix of digital and paper, compared to less than 20% of older generations.

Dealers who assume younger buyers want a fully digital process will miss the mark. Keep both paper and digital options available and highlight your ability to offer flexibility.

Winning Over the Next Generation

Gen Z may just be entering the car-buying market, but their influence is already reshaping the F&I office. Dealers who adapt with flexibility, transparency and security-focused offerings won't just capture Gen Z's first purchase. They'll build loyalty with what will be the wealthiest generation in history, while those who continue with business as usual risk being left behind.

Share This