3 Min Read • April 1, 2024

Robust Inventories Lift Buyer Attitudes

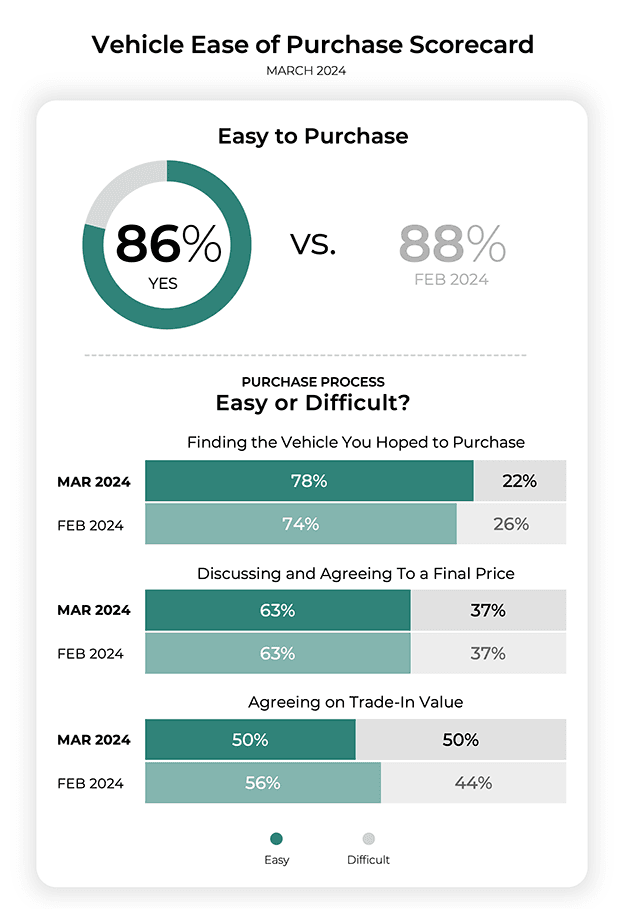

In February, the tracking CDK does of new car buyers returned its most positive results to date with nearly nine out of 10 (88%) respondents saying the purchase process was easy. Having moved the bar so high it’s no surprise that in March there was a dip to a still very high score of 86% for the Ease of Purchase scorecard.

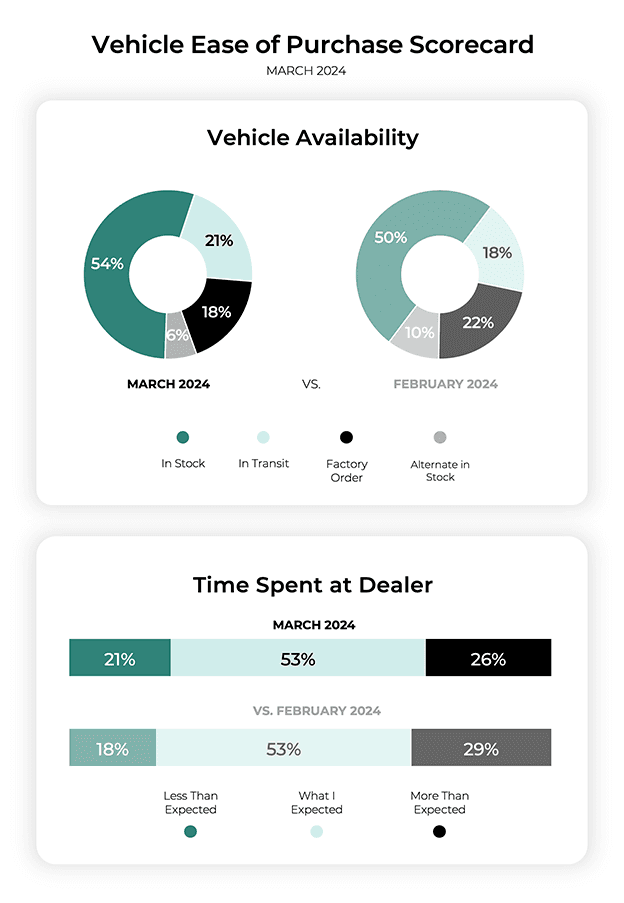

New car inventories are healthy and that showed through clearly in March’s results. More than half (54%) of car buyers found the vehicle they wanted in stock. That’s up from 50% in February and up significantly from last March’s number of 43%. Fewer people were ordering the vehicle, down to 18% from 22% in February, and choosing alternatives in stock, down to 6% from 10% last month.

In fact, when we asked if it was easy to find the vehicle they wanted in stock, 78% answered in the affirmative compared to a very high score of 74% just last month. There was a similar jump, from 81% to 87%, when respondents were asked if it was easy to take a test drive. Both of these scores are generally driven by higher inventory levels.

A number of those CDK surveyed praised the packed lots. For example, one respondent said there was a large number of cars on hand that “fit my personal preferences and even found one that had the custom paint job and interior how I wanted them.”

Only two parts of the process CDK tracks saw a dip in March — taking final delivery of the vehicle and agreeing to the trade-in price. Both fell six percentage points from March at 75% and 50% respectively. It’s likely delivery took a hit due to higher volumes of sales stretching the staffing at dealers while fluctuating used-car values dampened that part of the process for buyers.

Applying for credit, which has been a sore spot for buyers over the past year or so, held steady from last month at 66%, which is higher than March 2023’s figure of 63%.

Buyers also said they spent less time than they expected to complete the purchase. That number rose to 21%, from 18% in February, with the equivalent drop coming from those who said it took more time than expected. That’s a positive trend considering the increased volume of sales happening at most dealers.

These numbers are an optimistic sign as more buyers completed parts of the purchase process online before coming into the dealership to finish the deal. That number moved up significantly to 27% of all buyers in March from 21% in February but still off of last March’s higher marks of 32%.

The combination of increased inventory and steering buyers through an omnichannel path should deliver even stronger results as we move through the rest of 2024.

Share This

David Thomas is director of content marketing and automotive industry analyst at CDK Global. He champions thought leadership across all platforms, connecting CDK’s vast expertise to the broader market and trends driving our industry forward. David has spent nearly 20 years in the automotive world as a product evaluator, journalist and marketer for brands like Autoblog, Cars.com, Nissan and Harley-Davidson.